The Storm

Sep

13

Dear Friends,

Whoever I talk to these days in politics or business, has a feeling of uncertainty and risk, kind of doom in the back of his mind. And this is accelerating. Not a good omen for financial markets in the coming months and years. We have approached and discussed the topic with some of our partners systematically and wanted to share this with you for your personal consideration. We call it: the perfect storm.

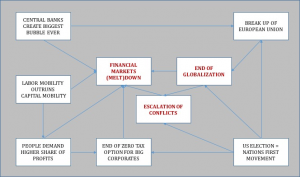

Actually, we see a series of inter-related mega trends, that all threaten financial markets in the short to mid term, but more fundamentally could also mean the end of the capital markets pre-dominance, that we have experienced for the last 25 years. The simultaneous hit/realization of some of these trends, could lead to very serious distortions on capital markets. And these trends, as you can see in the chart, can mutually enhance each other. The perfect storm.

(1) Central Banks have created the biggest financial market bubble of all times with QE, no or negative interest rates and by establishing with financial market players and governments the feeling, that with the slightest cough of market or economies, central banks will just increase the dose of liquidity medication. Dare to stop or decrease this dose, and financial markets will tremble.

(2) Technical possibilities and aspirations/desires from the generation entering the employment market, lead to an un-precendented level of labor mobility, flexibility, independence. The situation, where capital could flow wherever it wanted, free and untaxed, while labor had to stay at its workplace and bear the brunt of national taxation and social security payments is over, and we will experience the beginning of a revolution. Labor is catching up in bargaining power over capital.

(3) This is enhanced by the (justified) feeling of many people, that global growth and wealth concentration, the cream on the global profit soup, had been eaten up by the ultra rich and the big corporates. We will see much higher demands for re-distribution of income and wealth. And more violent.

(4) No good news for big corporates. The EU ruling on Apple is just the beginning. The times of zero taxation (to be precise, Apple had an effective tax rate of 0,005 % in the EU) are definitely over, this will nag on corporate profits and consequently on valuations of companies.

(5) The EU is close to break-up or complete stalemate. South against North, East against West, All against Brussels. And the Brexit talks did not even start. This will definitely have a strong negative impact on stability, growth and peace in the region.

(6) In the US elections we see the two most disliked and distrusted candidates ever competing to become President and to lead the most powerful nation of the World. Any outcome will not help markets. Trump has an out-spoken anti Wall street bias. His motto of “America First“ will lead to more isolation and disputes. Should Clinton win, she will have to move against Wall Street just to show that she is not the pure establishment breed, she indeed is. In any case, for the foreseeable future, the US will be less easy with Wall Street, more US focussed and more demanding with friends and allies.

(7) Ever higher globalization, which was the driver for global growth in the past years, has come to an abrupt end. All talks of TTIP, CETA and others are mere face-saving events than real discussions, and there will be for sure no real outcome. We are on the verge of de-globalization and the re-surrection of the nation state. Wherever you look, national, anti-establishment, anti-globalization, national pride and independence movements are advancing: Britain was leading, but Trump will trump this, but there are also elections in France, Germany, Italy and other nations coming, which all lead into the same direction. With global trade agreements and supra-national integration on the political agenda, politicians do not even dare to apply for office these days.

(8) Last but not least, the level of military and terrorist escalation is not only frightening, but a serious risk for global stability. In Syria, we experience for the first time since WW2, that not only the main world powers US and Russia, but also all regional powers like Turkey, Iran, Iraq and Saudi Arabia are involved with money, boots on the ground and more. Danger for escalation granted. And not only there. We still have Libya, Afghanistan, South China Sea, Ukraine and many more. Governments will increase over the next ten years significantly military and defense budgets. The peace premium that national budgets, consumers and financial markets have enjoyed with the end of the cold war will turn into the contrary.

Good news: the World has survived worse, and not all must come true. And there is still time for politicians and global leaders to wake up, and for us to prepare.